Dispatch #104: India’s evolving consumer economy: Lessons from the Indus Valley report

This dispatch explores how India's consumption patterns are evolving, from the rise of premiumization to the dominance of gated communities, with insights from the Indus Valley Annual Report.

The Indus Valley Annual Report 2025 is one of the most anticipated deep dives into India’s economic landscape. Blume Ventures published it, providing a unique perspective on India’s startup ecosystem, economic drivers, and evolving consumption patterns. It’s a goldmine for anyone interested in understanding how India spends, what it values, and where it’s heading.

This report is more than just a repository of data. It unpacks the underlying forces driving India's consumption economy. It examines how shifting income demographics, urbanization, and digital adoption influence consumer behavior. Thus, it provides a crucial lens through which businesses, investors, and policymakers can anticipate market movements and make informed strategic decisions.

Beyond data and trends, the report offers valuable lessons on the structural shifts shaping India’s economy. It helps us understand how different income groups are contributing to consumption, what sectors are benefiting from this shift, and where the potential challenges lie. The insights gleaned from this report are particularly crucial for businesses looking to cater to India's evolving consumer base, policymakers striving to create inclusive economic policies, and individuals keen to understand how these changes impact their everyday lives.

From the increasing dominance of India1—a high-income segment fueling discretionary spending—to the rise of gated communities as concentrated consumption hubs, the report highlights how affluence and aspirations are shaping India's marketplace. At the same time, it underscores growing concerns such as the widening economic disparity and the sustainability of this consumption-driven growth.

Whether it’s the rise of premiumization, the growth of gated communities, or the surge in international travel, these trends influence everything from the cost of living to job opportunities and investment choices. Understanding these patterns allows us to better navigate the complexities of India’s economic evolution.

In this dispatch, we break down the key consumption trends in India as outlined in Section 1 of the report, adding context and insights to help you navigate the numbers and patterns shaping the Indian economy.

Consumption as the Dominant Driver of India’s GDP

One of the defining features of India's economy is the central role that consumption plays in driving GDP growth. Unlike economies such as China, where investment and manufacturing have historically been the dominant forces behind expansion, India’s growth model is largely consumption-driven. Private Final Consumption Expenditure (PFCE) accounts for approximately 56-60% of India’s GDP, a figure that has remained consistent over the past two decades.

From a global perspective, India is already a consumption powerhouse. It is currently the 5th largest consumption market in the world, with private consumption contributing nearly 60% of its $3.7 trillion GDP. Moreover, India’s consumption growth rate outpaces that of many major economies, positioning the country as an attractive market for both domestic and international businesses.

However, while India’s overall consumption numbers are impressive, its per capita consumption remains considerably lower than that of countries like China, Indonesia, and developed markets in the West. This suggests that while the economy is expanding, purchasing power remains concentrated in a smaller, high-income segment of the population. This raises concerns about inclusivity and equitable economic participation, as consumption growth alone does not necessarily translate to widespread prosperity.

At first glance, this reliance on consumption might seem like a sign of economic strength, but a closer look reveals some stark realities. While India’s aggregate consumption figures are impressive, its per capita consumption tells a different story. Compared to other large economies, India significantly under-consumes on a per capita basis. The report makes an important comparison with China, which had similar consumption levels in 2010 but has since outpaced India due to sustained income growth and broader economic expansion.

The Rise of India1: A ‘High-Income’ Country Within India

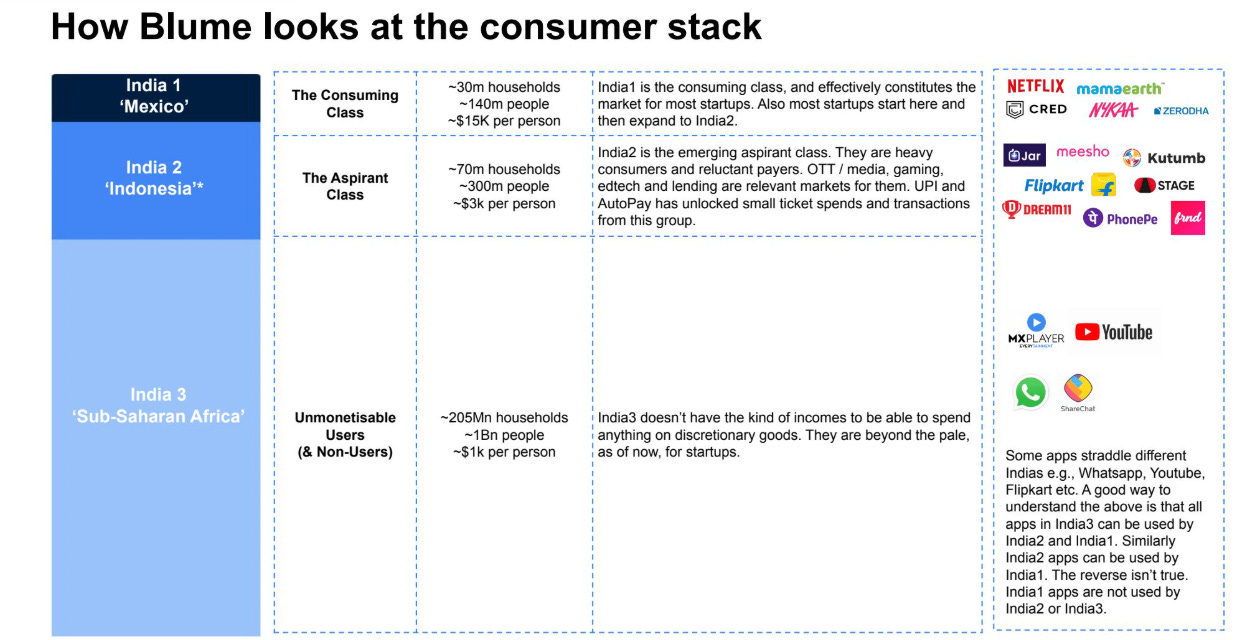

Blume Ventures has previously explored the concept of India1, a term used to describe the top 10% of India’s population that enjoys significantly higher incomes and dominates discretionary spending. With a per capita income of around $15,000, this group is at a consumption level comparable to high-income economies. If India1 were considered an independent country, it would rank among the ten most populous nations in the world and meet the World Bank’s criteria for a high-income economy.

The economic importance of India1 cannot be overstated. This segment drives high-value industries such as luxury goods, high-end real estate, fintech adoption, and premium services. Not only does India1 spend disproportionately more on goods and services, but it also dictates consumer trends and business strategies. With higher disposable income, India1 is fueling the growth of categories such as premium automobiles, gourmet food, designer apparel, and international travel.

However, the growth of India1 is unique in that it is not widening as rapidly as one might expect. Rather than a growing middle class entering this affluent bracket, existing members are seeing their wealth multiply at a much faster rate. This deepening rather than widening of the affluent class presents both opportunities and challenges. On one hand, businesses targeting high-end consumers can expect consistent and growing demand. On the other, a lack of broad-based economic inclusion could mean that much of the country’s population remains on the periphery of this consumption boom, limiting overall economic stability.

Blume Ventures’ analysis suggests that businesses and policymakers must take a nuanced approach to this phenomenon. While catering to the increasing demands of India1 remains crucial for economic growth, ensuring that a larger segment of the population moves up the income ladder will be essential for long-term sustainability. This requires targeted investments in education, infrastructure, and job creation that enable more people to participate in and benefit from India’s rising prosperity.

India’s Travel Obsession: Outbound Travel & LRS Remittances Surge

Indians are spending more on travel than ever before, even as inflationary pressures persist. Outward remittances under the Liberalized Remittance Scheme (LRS) have soared to $31.7 billion in FY24, with a staggering $17 billion allocated specifically to international travel. This surge signals a shift in consumer behavior where travel has become a non-negotiable expense, a priority over traditional savings or investments.

According to articles like this, this, and this, Indian travelers are prioritizing international destinations, with top choices including Dubai, the US, and European countries. This demand is driven by rising disposable incomes, aspirational lifestyles, and the growing accessibility of online travel services. Additionally, business travel and the rise of remote work have contributed to an increase in both leisure and work-related international trips.

Indian consumers today spend not only on flights and accommodations but also on premium travel experiences such as luxury cruises, adventure tourism, and high-end shopping at international destinations. The above-mentioned articles report that spending patterns have shifted from budget travel to experience-based tourism, with travelers willing to pay for personalized, high-quality services. Visa-free access and simplified travel regulations in several countries have further fueled this trend.

Financial services firms are capitalizing on this shift, with travel fintech companies offering innovative payment solutions such as forex cards, BNPL (Buy Now, Pay Later) schemes, and specialized travel credit cards. Airlines and luxury hospitality chains are also tailoring their offerings to cater to high-spending Indian travelers. Moreover, premium brands at international airports have reported increased spending by Indian tourists, highlighting their growing purchasing power.

Additionally, this surge in outbound travel has policy implications. The government has responded by increasing scrutiny of overseas remittances under LRS and taxation policies to monitor high-value transactions. While international travel is a sign of economic confidence, ensuring that domestic tourism also benefits from this growing affluence remains a policy challenge.

The evolving nature of Indian travel expenditure reflects a broader shift in consumer behavior—one that prioritizes global experiences and aspirational spending. This trend is likely to continue shaping industries such as aviation, fintech, and hospitality in the years to come.

Gated Communities: The Powerhouses of Consumption

Urban India’s gated communities are emerging as self-sustaining economic hubs, housing the country’s most affluent and consumption-driven households. The report finds that 40% of households in India’s top 50 cities now reside in gated communities, contributing to more than 50% of total consumption expenditure.

These communities serve as concentrated economic ecosystems where residents enjoy access to high-end retail outlets, premium healthcare facilities, international school systems, and state-of-the-art fitness centers. The McKinsey Global Institute suggests that these exclusive enclaves are becoming focal points for aspirational consumption, with residents displaying higher purchasing power across categories such as luxury automobiles, smart home solutions, and organic produce.

Retailers and e-commerce giants are rapidly adapting their strategies to cater to gated communities, offering personalized services, priority delivery, and concierge-based shopping experiences. Companies such as Amazon, BigBasket, and Tata Cliq have reported a significant rise in orders originating from gated communities, with an increased preference for premium brands and imported goods.

The Redseer report explains the socio-economic homogeneity within the gated communities:

Most gated communities are characterized by commonalities across social and economic axes. For eg- certain gated communities in Delhi inhabit Government servants in a particular income range; similarly most of the startup founders/ CXOs prefer certain gated communities in Bengaluru; similar examples can be found in different cities across community lines. The spend patterns of households in these communities tend to be similar driven by not just common backgrounds but also social comparisons.

While gated communities represent a booming consumption market, they also raise concerns about socio-economic segregation. The disparity between high-income enclaves and surrounding urban areas often leads to stark contrasts in infrastructure quality, access to essential services, and employment opportunities. Policymakers must strike a balance between fostering premium urban development and ensuring inclusive growth by investing in broader urban infrastructure, improving public transportation, and promoting policies that integrate various economic segments into the growth story.

Gated communities are undeniably transforming India's urban landscape, creating concentrated hubs of wealth and consumption. Businesses looking to tap into this segment must offer hyper-personalized experiences, exclusive brand partnerships, and tailored financial products to cater to the distinct needs and preferences of affluent urban consumers.

India’s consumption-driven growth presents both opportunities and challenges. While rising affluence and urbanization are expanding markets, large sections of the population still struggle with affordability and access to goods and services. The divide between discretionary and non-discretionary spending, the persistence of unbranded retail, and the limited penetration of financial and consumer products highlight the need for inclusive growth strategies. Businesses must innovate to tap into evolving consumption patterns, while policymakers must ensure that economic progress benefits a broader segment of society. India’s future as a global consumption leader will depend on how effectively it bridges these gaps and fosters widespread economic participation.